The “One Big Beautiful Bill” (OBBB), passed by Congress in July 2025, modifies key elements of the Inflation Reduction Act’s (IRA) clean electricity tax credits. Among other changes, the bill accelerates solar and wind phaseout dates: projects must be placed in service by the end of 2027 or begin construction by July 4, 2026, to remain eligible for the production and investment tax credits.

But a more foundational shift—one that rewires how components are sourced—is the introduction of Foreign Entity of Concern (FEOC) sourcing restrictions. More than $47 billion in planned U.S. battery storage could be at risk under these new rules, potentially jeopardizing efforts to keep the grid stable as electricity demand climbs.

What are the FEOC provisions?

OBBB includes several restrictions related to Foreign Entities of Concern (FEOCs), but one of the most consequential for clean energy projects is the “material assistance” rule. This provision bars tax credit eligibility for projects that rely on equipment or materials linked to prohibited foreign entities (PFEs)—whether through sourcing, manufacturing, or processing. This analysis focuses on the material assistance provision, which directly affects component sourcing.

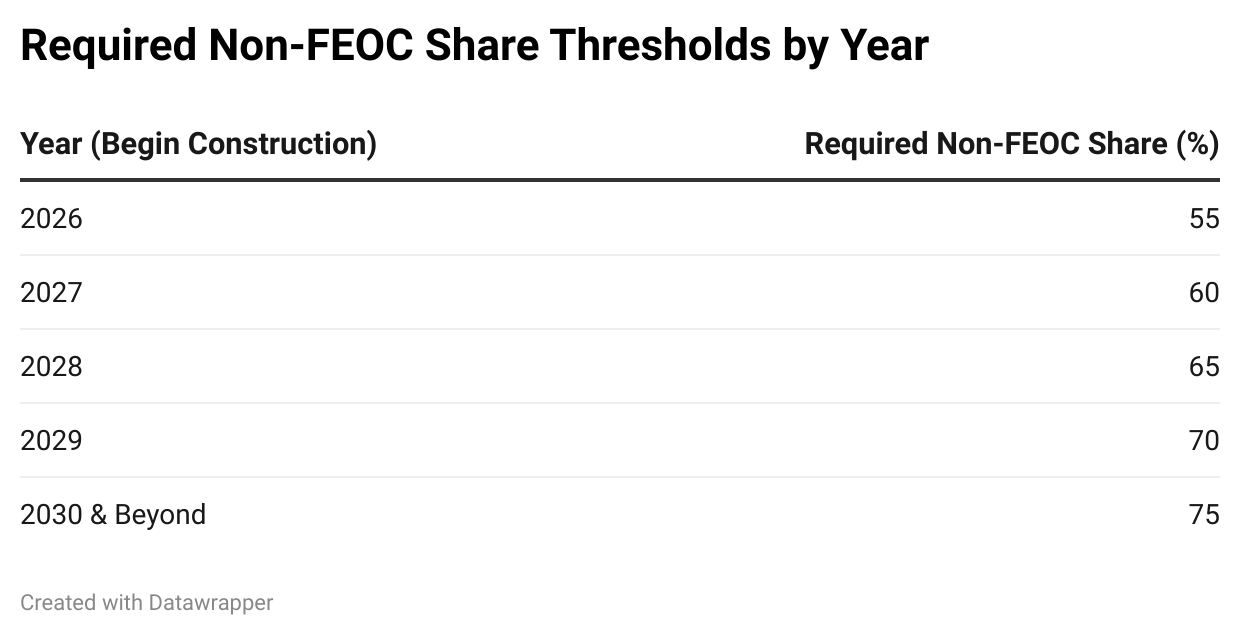

The policy takes effect for projects beginning construction after December 31, 2025, and ramps up over time via increasingly strict thresholds for allowable FEOC-linked content. While detailed implementation guidance is still pending, the implications are already clear: unless U.S. supply chains diversify rapidly, many projects risk losing eligibility.

Modeling the Supply Chain Impact

To estimate the real-world consequences of the FEOC restriction, we developed a component-level exposure model focused on solar, wind, and lithium-ion battery storage. Our methodology includes:

- Component sourcing analysis: Using international trade data, we estimate the share of key components—modules, inverters, trackers, cables, battery cells, etc.—that originate from or pass through FEOCs, primarily China. We adjust these shares to account for indirect FEOC exposure, including upstream sourcing and ownership risk.

- System-level exposure calculation: For each representative system (solar, wind, storage), we compute a weighted FEOC cost share by aggregating component-level exposure using their relative contribution to total system cost.

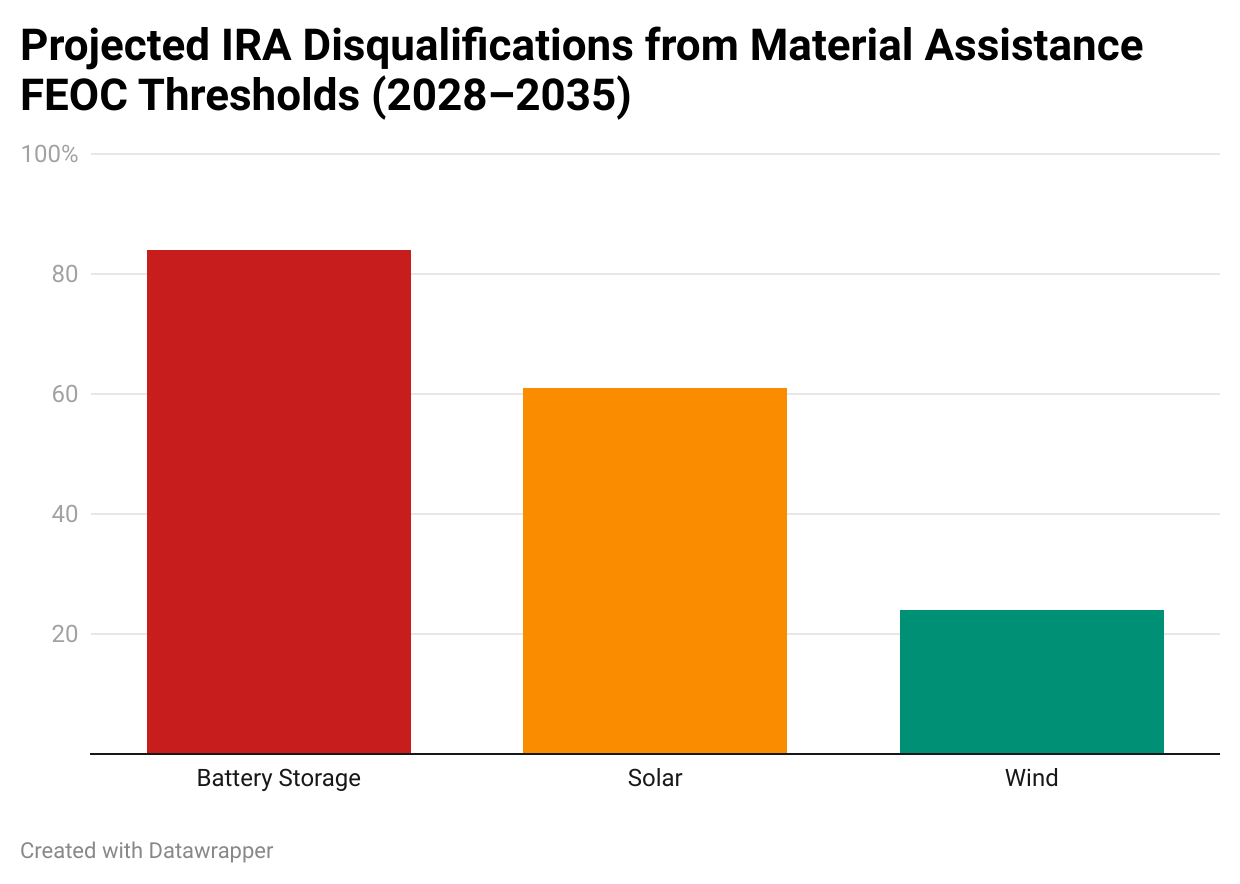

- Threshold comparison and deployment loss estimation: We compare this FEOC cost share to the maximum allowable threshold—referred to in the law as the Material Assistance Cost Ratio (MACR). If the project exceeds this limit, the model estimates how much IRA-induced deployment would be curtailed due to ineligibility.

Battery Storage: The Most Exposed Technology

Our analysis shows that battery storage projects are most at risk under the FEOC restriction, due to the overwhelming dominance of China across the lithium-ion battery supply chain. This includes everything from critical mineral refining—such as lithium, cobalt, and nickel—to the midstream and downstream manufacturing of cathodes, anodes, and battery cells.

Even with aggressive efforts to localize production, many battery storage projects may struggle to comply with the rising Minimum Non-FEOC Share thresholds. These requirements increase over time and are stricter for energy storage than for other technologies. In effect, the bar for compliance gets higher just as supply chains are working to diversify—potentially canceling out any progress made through reshoring or allied sourcing.

These FEOC-related sourcing risks are also present in solar and wind, but they’re not the most consequential part of the bill for those technologies. Instead, the early termination of tax credits is expected to drive larger reductions in deployment. Still, key components like solar modules and wind nacelles often involve FEOC-linked inputs, and some projects may ultimately fail to meet eligibility requirements.

Geographic Impacts: Where the Risk Is Concentrated

Using Clean Investment Monitor, by Rhodium Group and MIT Center for Energy and Environmental Policy Research (MIT-CEEPR), we identified utility-scale battery storage projects scheduled to begin construction in 2026 or later—the projects directly subject to the FEOC material assistance restriction. Texas stands out as the most exposed state by a wide margin, with over $20 billion in at-risk capital investment, followed by Oregon, California, Nevada, and Washington, each with several billion dollars of planned development. These states collectively represent the bulk of national utility-scale storage investment in the current post-2025 pipeline.

The geographic concentration of projects in the Southwest and West suggests that FEOC restrictions could have disproportionate impacts in regions with fast-growing electricity demand and ambitious grid expansion plans. The policy risk is especially acute for states like Texas, where multiple gigawatts of battery capacity may be disqualified from clean energy tax credits if the supply chain does not diversify quickly enough.

Other Technologies Face Murky Waters

While our analysis shows that battery storage is currently the most exposed to FEOC-related disqualification risk, other grid-firming technologies like nuclear, geothermal, and hydropower may face similar challenges as the rules expand and guidance evolves. These technologies also rely on globally sourced components, and for early-stage or capital-intensive systems—like advanced nuclear reactors or next-generation geothermal—the loss of tax credit eligibility could be especially damaging.

The IRS has published standardized tables to help solar, wind, and storage projects estimate material costs for domestic content compliance. But no similar resources exist for geothermal, hydropower, or nuclear, leaving developers in these sectors with little clarity on how to assess compliance with sourcing rules. That gap could become a barrier to project financing or timely deployment—particularly if future guidance adds complexity or reduces flexibility.

A Call for Smart Implementation

Grid-firming technologies like battery storage, nuclear, geothermal, and hydropower are essential to keeping the U.S. grid stable amid rapid load growth and growing stress on existing infrastructure. As electricity demand surges—driven by electrification, industrial expansion, and data center growth—these technologies play a critical role in managing peak loads, supporting reliability, and enabling system flexibility. Deployment has reached historic highs in some sectors, but this momentum is fragile.

To avoid slowing the pace of grid stabilization, implementation guidance must be transparent, flexible, and grounded in commercial realities. This includes:

- Clear ownership verification rules

- Allowances for transitional compliance periods

- Mechanisms for assessing indirect sourcing risk without imposing excessive administrative burdens

These technologies are ready to scale. The question is whether federal policy will clear the way—or get in its own way.